ADU Californication: Guide to ADU Financing Options

Unlock the Financial Potential of Your Property with Smart ADU Financing

California's housing crisis has sparked an ADU revolution. Accessory Dwelling Units (ADUs) offer homeowners an incredible opportunity to add value to their property while generating rental income or providing housing for family members. Navigating the financing landscape can be overwhelming. Whether you're considering a Fannie Mae loan, FHA financing, conventional options, DSCR loans, or construction financing, this guide will help you understand your options and make informed decisions.

The key to success? Understanding your financing options and choosing a trusted, quality builder who can complete your ADU quickly so you can start reaping the benefits.

Major 2024-2025 Financing Updates: Game Changers for ADU Development

Fannie Mae ADU Update: Enhanced Flexibility

Fannie Mae has revolutionized ADU financing with recent policy updates that make it easier than ever to fund your project. Key changes include:

Rental Income Consideration: You can now use projected ADU rental income to qualify for your loan, even if the unit isn't completed yet. This means the future income from your ADU can help you qualify for a larger loan amount.

Appraisal Requirements: Updated guidelines allow appraisers to consider the added value of a planned or under-construction ADU, increasing your property's appraised value before the unit is even finished.

Cash-Out Refinance Options: Homeowners can use cash-out refinancing to fund ADU construction, with up to 80% loan-to-value ratio on primary residences.

Streamlined Documentation: Reduced paperwork requirements make the application process faster and less burdensome.

FHA ADU Update: Opening Doors to More Homeowners

The Federal Housing Administration has also modernized its approach to ADUs, making financing more accessible:

Lower Down Payments: FHA loans require as little as 3.5% down, making ADU financing accessible to more homeowners who may not have substantial equity.

ADU Value Recognition: FHA now allows the value of an ADU to be included in the property appraisal for both purchases and refinances.

Rental Income Qualification: Similar to Fannie Mae, FHA permits borrowers to use 75% of projected ADU rental income to qualify for the loan.

Extended Loan Terms: FHA offers 30-year fixed-rate mortgages, providing long-term stability and predictable payments.

Understanding Your ADU Financing Options

Conventional Mortgage Options

Conventional loans remain a popular choice for homeowners with good credit and substantial equity. Here's what you need to know:

Pros:

Competitive Interest Rates: Generally lower rates than government-backed loans for borrowers with excellent credit (typically 0.25% - 0.50% lower).

No Upfront Mortgage Insurance: Unlike FHA loans, conventional loans don't require upfront mortgage insurance premiums if you have 20% equity.

Higher Loan Amounts: Can borrow up to the conforming loan limit ($766,550 in most California counties, higher in expensive areas like Los Angeles and San Francisco).

Flexible Property Types: Works for primary residences, second homes, and investment properties.

Cash-Out Options: Refinance and pull out up to 80% of your home's value (or 75% for investment properties) to fund ADU construction.

Cons:

Stricter Qualification Requirements: Typically require credit scores of 620 or higher (680+ for best rates), with most lenders preferring 700+.

Higher Down Payments: May require 15-20% down payment for cash-out refinances, compared to FHA's lower requirements.

Income Verification: Requires extensive documentation of income, assets, and employment history.

Debt-to-Income Limits: Total debt-to-income ratio typically can't exceed 43% (sometimes 50% with compensating factors).

DSCR Loans: Perfect for Investment-Focused ADUs

Debt Service Coverage Ratio (DSCR) loans are ideal for investors and homeowners who want to finance based on the property's income potential rather than personal income:

Key Features:

No Personal Income Verification: Qualification based solely on the property's rental income, not your W-2s or tax returns.

Ideal for Self-Employed: Perfect for business owners, freelancers, or those with complex income situations.

Quick Closing: Less documentation means faster approval and closing times (typically 2-3 weeks).

Unlimited Properties: No limit on the number of financed properties, unlike conventional loans.

Investment Property Focus: Can be used for properties you don't live in, making them perfect for building rental ADUs on investment properties.

Requirements:

DSCR Ratio: The property's monthly rental income should exceed monthly debt obligations by at least 1.0x (though 1.25x gets better rates). This is the Net Operating Income divided by the Total Debt Service. If your ADU has a Net Operating Income of $108,000 and a Total Debt Service of $90,000, your DSCR Ratio is 1.2 (108,000/90,000 = 1.2).

Down Payment: Typically 20-25% for investment properties.

Credit Score: Minimum 660, but 700+ gets better terms.

Interest Rates: Usually 1-2% higher than conventional loans, but the flexibility often justifies the cost.

Construction Loans: Built for Building

Construction loans are specifically designed for ADU projects, providing funds as construction progresses:

How They Work:

Draw Schedule: Funds are released in stages as construction milestones are completed (foundation, framing, roofing, completion).

Interest-Only Payments: During construction, you typically pay only interest on the disbursed amount.

Conversion Option: Many construction loans automatically convert to permanent mortgages once the ADU is completed (construction-to-permanent loans).

Timeline: Typically 6-12 months for construction phase, then converts to 15 or 30-year permanent financing.

Considerations:

Detailed Plans Required: Lenders need comprehensive architectural plans, contractor bids, and timeline estimates.

Higher Interest Rates: Construction phase rates are typically 1-2% higher than permanent mortgages due to increased risk.

Appraisal Requirements: Need both current property appraisal and "subject to completion" appraisal projecting finished value.

Qualified Builder Required: Lenders require licensed, insured contractors with proven track records.

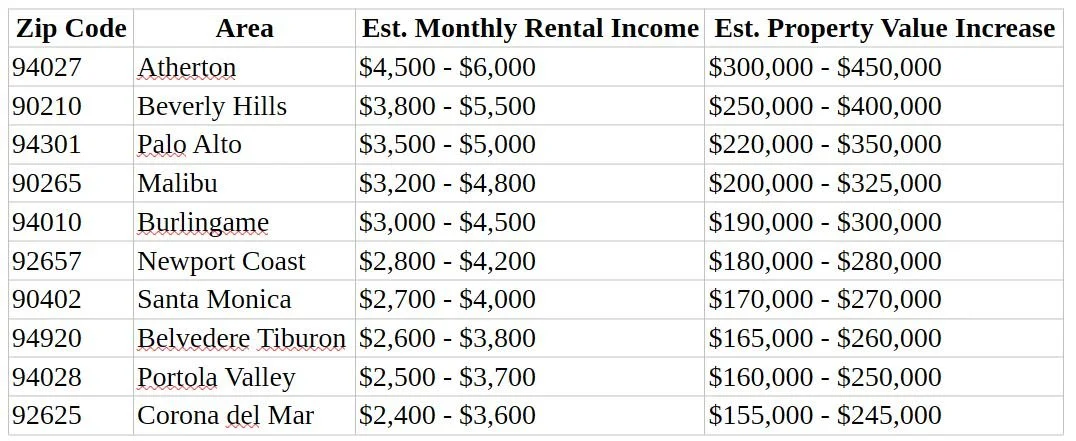

The Financial Impact: Top 10 California Zip Codes

Understanding the potential return on investment is crucial when planning your ADU. Below are estimates for the top 10 high-value California zip codes, showing potential monthly rental income and property value increases. These figures are based on current market data and can vary based on specific location, ADU size, and finishes.

Note: These estimates are based on 500-800 square foot ADUs with modern finishes in these high-demand markets. Actual values vary based on specific location, ADU size, quality of ADU, and current market conditions. Property value increases reflect the theoretic added equity from a completed, quality ADU.

Why Speed Matters: Time to Completion is Crucial

When it comes to ADU construction, time truly is money. Every month your ADU sits incomplete is a month of lost rental income and delayed returns on your investment. Consider this:

Lost Income: In high-value California markets, you could be missing out on $3,000-$5,000 per month in rental income for every month of delay.

Construction Loan Interest: If using a construction loan, you're paying interest-only payments without any offsetting rental income during the build period.

Market Timing: California rental markets are competitive. Completing your ADU faster means capturing tenants at today's rates rather than risking potential market changes.

Cost Escalation: Construction costs and material prices continue to rise. A 6-month project completed in 4 months could save thousands in material and labor cost inflation.

The traditional ADU construction timeline can take 12-18 months from start to finish, but it doesn't have to. With the right system, your builder can significantly accelerate this timeline while maintaining quality.

The Solution: MOMO by LuxMod

Speed Without Compromise

Streamlined Timelines: MOMO specializes in efficient ADU models that your builder or GC can complete in 4-6 months, compared to the industry standard of 12-18 months.

Panelized Advantages: Advanced panelized construction techniques reduce on-site construction time while maintaining superior quality control.

Quality You Can Trust

Premium Materials: High-end finishes and durable construction that maximize both property value and rental appeal.

Energy Efficiency: Modern insulation, HVAC systems, and appliances that reduce operating costs and attract eco-conscious tenants.

Code Compliance: Full compliance with California building codes and local regulations, ensuring smooth permitting and inspections.

Warranty Protection: Comprehensive warranties that protect your investment long after completion. (Check with MOMO Homes for the warranty specifics when you purchase your model).

Making Your Financing Decision: A Step-by-Step Approach

Choosing the right financing option requires careful consideration of your specific situation. Here's a framework to guide your decision:

Step 1: Assess Your Financial Position

Current equity in your property

Credit score and history

Income documentation (W-2, tax returns, business income)

Debt-to-income ratio

Available cash for down payment

Step 2: Define Your Goals

Primary Use: Long-term rental income, short-term rental (Airbnb), family housing, or future flexibility?

Timeline: How quickly do you need rental income to start flowing?

Investment Horizon: Planning to hold long-term or potentially sell in the near future?

Step 3: Match Financing to Your Situation

Choose Fannie Mae/Conventional if:

You have strong credit (700+)

Stable, documented W-2 income

20%+ equity available

You want the lowest possible interest rate

Choose FHA if:

Limited cash for down payment (3.5% available)

Good but not excellent credit (580-700)

This is your primary residence

You need help qualifying with projected rental income

Choose DSCR if:

Self-employed or complex income situation

Investment property or non-owner occupied

Strong rental income potential in your area

You prefer simplified documentation

You're building multiple ADUs across several properties

Choose Construction Loan if:

You need funds released as the project progresses

Don't have full project cost in cash or equity

Want to minimize upfront capital requirements

Calculating Your Return on Investment

Let's look at a realistic example for a property in Santa Monica (zip code 90402):

Project Costs:

ADU Construction (600 sq ft, quality finishes): $225,000

Permits and fees: $15,000

Landscaping and utilities: $10,000

Total Investment: $250,000

Financing Option 1: Conventional Cash-Out Refinance (20% down)

Amount Financed: $200,000 at 7% interest

Monthly Payment: $1,330

Monthly Rental Income: $3,200 (conservative estimate)

Monthly Cash Flow After Mortgage: $1,870

Annual Cash Flow: $22,440

Cash-on-Cash Return on $50,000 down payment: 44.8% annually

Property Value Increase: $220,000 (conservative estimate)

Total First-Year Benefit: $22,440 cash flow + equity gain from property value increase

The Speed Advantage:

If your builder/GC has your MOMO ADU Model completed in 5 months versus a traditional builder's 15 months, you gain 10 months of rental income sooner. At $3,200/month, that's $32,000 in additional income in the first full year after completion, plus avoiding 10 months of construction loan interest payments.

Conclusion: Your ADU Investment Starts Now

The ADU revolution in California is providing homeowners with unprecedented opportunities to build wealth, generate income, and address the housing shortage. With recent updates to Fannie Mae and FHA guidelines, financing has never been more accessible. Whether you choose conventional financing, DSCR loans, or construction financing, the key is to:

Understand your financing options thoroughly

Choose the right financing for your specific situation

Partner with experienced, quality builders who can complete projects quickly

Move quickly to start generating rental income

MOMO by LuxMod has ADU models that deliver speed, quality, and expertise that turns your ADU vision into profitable reality. In California's competitive real estate market, the homeowners who act decisively with trusted partners are the ones who maximize their returns.

Your ADU can start generating $30,000-$60,000 annually in rental income within months, not years. The property value increase alone often exceeds the construction cost. The question isn't whether you should build an ADU—it's when will you start?

The time for ADU Californication is now. Your property's potential is waiting to be unlocked.

Disclaimer:

This blog post is for informational purposes only and does not constitute financial, legal, or tax advice. Financing terms, interest rates, and property values vary based on individual circumstances, market conditions, and specific locations. Rental income and property value estimates are based on current market data and are not guaranteed. Consult with qualified financial advisors, mortgage professionals, and legal counsel before making any financing or investment decisions. All loan terms are subject to lender approval and individual creditworthiness.