What Is an ADU?

Everything You Need to Know (And Why LuxMod by MOMO Sets the Gold Standard)

If you've been hearing the term "ADU" more and more lately, you're not alone. Accessory Dwelling Units have exploded in popularity across Idaho, California, Washington, and Oregon, heck almost everywhere, and for good reason. Whether you're a homeowner in Boise, Los Angeles, Seattle, or Portland looking to generate rental income, house a family member, or simply increase the value of your property, an ADU could be one of the smartest investments you ever make.

In this guide, we'll break down exactly what an ADU is, what an ADU home looks like in practice, and why LuxMod by MOMO stands out as the most complete, top-rated ADU solution available to homeowners across the Pacific Northwest and beyond.

What Is an ADU?

An ADU (Accessory Dwelling Unit) is a secondary residential structure built on the same lot as a primary single-family home. Think of it as a fully self-contained living space that includes its own entrance, kitchen, bathroom, and sleeping area, all situated on your existing property.

ADUs go by many names depending on where you live:

Granny flats

In-law suites

Backyard cottages

Casitas

Secondary suites

Detached guest houses

Regardless of the name, the concept is the same: a complete, independent living unit that coexists with your main home on a single property.

ADUs have gained massive momentum in recent years, particularly in California, Oregon, Washington, and increasingly in Idaho, as housing affordability crises have pushed state and local governments to relax zoning restrictions and streamline permitting. Whether you're searching for an ADU in Boise, Idaho, an ADU in Sacramento or Los Angeles, California, a backyard cottage in Seattle or Spokane, Washington, or a detached guest house in Portland or Eugene, Oregon, the process has never been more accessible.

What Is an ADU Home?

An ADU home is more than just a shed or a garage conversion, it's a fully functional residential dwelling. A true ADU home is designed for comfortable, independent living and typically includes:

Full Kitchen Facilities: A proper ADU home features a complete kitchen with appliances, counter space, and cabinetry, allowing occupants to live fully independently without relying on the main house.

Private Bathroom: A dedicated bathroom with a shower or bath, toilet, and sink is a non-negotiable component of any legitimate ADU.

Dedicated Living and Sleeping Space: Whether it's a studio-style open floor plan or a multi-bedroom layout, an ADU home provides comfortable living quarters designed for day-to-day life.

Separate Entrance: Privacy is paramount. A proper ADU home has its own entrance, keeping both the primary homeowner and the ADU occupant comfortable and independent.

Utility Connections: Electricity, plumbing, heating, and cooling systems make an ADU home a true year-round living solution, whether it's braving the winters of Boise or Coeur d'Alene, Idaho, the mild climate of Portland, Oregon, the rainy seasons of Seattle, Washington, or the hot summers of Southern California.

ADU homes come in several formats. Detached ADUs are standalone structures separate from the main house, the most popular and versatile option. Attached ADUs share a wall with the primary residence. Garage conversion ADUs transform an existing garage into livable space. And Junior ADUs (JADUs) are smaller units carved from within the existing home.

Of all these options, detached ADUs tend to offer the greatest privacy, flexibility, and long-term value, and that's exactly where LuxMod by MOMO excels.

ADU Laws and Regulations by State

Understanding your local ADU regulations is a critical first step. Here's a quick snapshot of where each state stands:

ADU Laws in California

California has become the most ADU-friendly state in the nation. Landmark legislation has eliminated many of the traditional barriers — reducing setback requirements, capping fees, and mandating faster permit processing times. Homeowners in Los Angeles, San Diego, San Jose, Sacramento, Oakland, Fresno, and every city in between have unprecedented access to ADU development. If you own property in California, there has never been a better time to build an ADU. Searches like "ADU California," "granny flat Los Angeles," "backyard cottage San Diego," and "ADU permit Sacramento" are among the most common in the country, and for good reason.

ADU Laws in Oregon

Oregon passed sweeping housing reform legislation that legalized ADUs statewide even in areas that previously prohibited them. Portland, Eugene, Salem, Bend, and Medford homeowners can now add an ADU with fewer bureaucratic hurdles than ever before. Oregon's commitment to addressing its housing shortage has made it one of the most progressive ADU states in the country. If you're searching for an ADU in Portland, a backyard cottage in Eugene, or a secondary suite in Bend, Oregon's regulatory environment is firmly on your side.

ADU Laws in Washington

Washington State has made significant strides in ADU accessibility, with cities like Seattle, Spokane, Tacoma, Bellevue, and Olympia updating their ADU ordinances to allow more flexibility on lot sizes, setbacks, and owner-occupancy requirements. Seattle ADUs, sometimes called backyard cottages or DADUs (Detached Accessory Dwelling Units), are among the most well-established in the Pacific Northwest. If you own property anywhere in Washington, an ADU is a legitimate and increasingly streamlined path to additional income and housing flexibility.

ADU Laws in Idaho

Idaho is an emerging ADU market with growing momentum. Cities like Boise, Meridian, Nampa, Idaho Falls, and Coeur d'Alene are seeing rising interest in ADU development as population growth drives housing demand. The Treasure Valley — encompassing Boise, Meridian, Eagle, Nampa, and Caldwell — is one of the fastest-growing regions in the entire country, making it a prime environment for ADU investment. While Idaho's ADU regulations vary by municipality, the trend is clearly moving toward greater flexibility, making now an ideal time to explore your options before competition increases. Searches for "ADU Boise Idaho," "granny flat Meridian," "in-law suite Coeur d'Alene," and "backyard cottage Nampa" are all on the rise.

Why LuxMod by MOMO Offers the Best, Most Complete ADUs on the Market

When it comes to choosing an ADU in Idaho, California, Washington, or Oregon, not all options are created equal. The difference between a basic ADU and a truly exceptional one comes down to quality of design, completeness of construction, ease of installation, and long-term livability. LuxMod by MOMO checks every single box and then raises the bar.

Complete, Turnkey Solutions

One of the biggest headaches in the ADU industry is coordinating dozens of moving parts: design, engineering, permitting, manufacturing, delivery, and installation. Most ADU companies hand you off at some point and leave you scrambling. LuxMod by MOMO takes a fully integrated, turnkey approach — delivering a complete ADU solution from concept to completion. Whether you're a homeowner in Boise, Portland, Seattle, or Los Angeles, you're not left managing a fragmented process. Everything is handled with precision and professionalism.

Otium model by LuxMod by MOMO

Premium Construction Quality

LuxMod by MOMO ADUs are built to a standard that far exceeds typical prefab or modular construction. Every unit is engineered for durability, energy efficiency, and aesthetic excellence. The materials, the finishes, the structural integrity, all of it reflects a commitment to quality that's rare in this industry. When you invest in a LuxMod by MOMO ADU, you're getting a structure built to last and designed to impress, whether it's standing up to Idaho winters, California heat, Oregon rain, or Washington weather.

Thoughtful, Modern Design

Functionality matters, but so does how your ADU looks and feels. LuxMod by MOMO models are designed with a modern, sophisticated aesthetic that complements a wide range of architectural styles. These aren't cookie-cutter boxes — they're thoughtfully designed living spaces that feel like a true home, not an afterthought. Perfect for the design-forward neighborhoods of Portland, Seattle, and the Bay Area, and equally well-suited to the growing communities of Boise and the Treasure Valley.

Faster Delivery and Installation

Traditional ADU construction can take 12 to 18 months or longer. LuxMod by MOMO's approach dramatically compresses that timeline, getting you to a completed, livable ADU faster than conventional methods without sacrificing quality. For homeowners eager to start generating rental income in competitive markets like Los Angeles, San Francisco, Seattle, or Portland, that speed advantage matters enormously.

Energy Efficiency Built In

LuxMod by MOMO ADUs are designed with energy performance in mind. From insulation to windows to HVAC options, the units are built to reduce energy consumption and operating costs, a major advantage no matter where you're located, from the high desert climate of Boise to the temperate Pacific Northwest to the sun-soaked cities of Southern California.

Maximized Return on Investment

Whether you're planning to rent your ADU on the long-term market or generate short-term rental income, a LuxMod by MOMO ADU maximizes your return. The combination of premium quality, attractive design, and complete livability commands top-dollar rents and significantly boosts property values in every market from Sacramento and San Diego to Eugene and Bend to Tacoma and Spokane to Meridian and Coeur d'Alene.

LuxMod by MOMO: A Top-Rated ADU Model for Today's Homeowners

In a crowded ADU marketplace across Idaho, California, Washington, and Oregon, LuxMod by MOMO has distinguished itself as one of the most sought-after and top-rated ADU models available. Here's why homeowners, real estate investors, and ADU professionals consistently rank LuxMod by MOMO at the top:

Comprehensive Offerings — LuxMod by MOMO offers a range of ADU models to suit different lot sizes, needs, and budgets. Whether you need a compact studio ADU or a more spacious multi-bedroom layout, there's a LuxMod model that fits your situation perfectly — no matter where in the West you call home.

Proven Track Record — LuxMod by MOMO has built a reputation for delivering on its promises. Homeowners from Boise to Bend, from Seattle to San Diego consistently report satisfaction with the quality of their units, the professionalism of the process, and the performance of the finished product.

Ideal for All Use Cases — Rental income, multigenerational living, home office space, guest accommodations, all of these uses is the ideal case to use LuxMod by MOMO ADUs since they are versatile enough to serve every purpose you might envision. In high-demand rental markets like Los Angeles, Portland, and Seattle, a LuxMod ADU can pay for itself faster than you'd expect.

Compliance and Permitting Support — Navigating local ADU regulations in California, Oregon, Washington, or Idaho can be overwhelming. LuxMod by MOMO's expertise means you're not going through that process alone. Their team understands the regulatory landscape across these states and helps ensure your project moves through permitting efficiently.

Is an ADU Right for You?

If you own property in Idaho, California, Washington, or Oregon and you're looking to unlock its full potential, the answer is almost certainly yes. ADUs offer:

Passive rental income that can offset your mortgage or fund your retirement

Increased property value that pays dividends when you sell

Flexible housing options for aging parents, adult children, or caregivers

A sustainable housing solution that makes use of existing land and infrastructure

The rental market in cities like Boise, Los Angeles, Seattle, and Portland is strong, and a high-quality ADU puts you in an excellent position to capitalize on it. The only question is: which ADU is right for you? And if you want the best, a complete, high-quality, top-rated ADU solution, the answer is LuxMod by MOMO.

Frequently Asked Questions About ADUs

What is an ADU in California? In California, an ADU (Accessory Dwelling Unit) is a secondary residential unit on a single-family or multifamily lot. California's ADU laws are among the most permissive in the nation, making it easier than ever for homeowners in Los Angeles, San Diego, Sacramento, San Francisco, Fresno, and beyond to add income-generating units to their properties.

What is an ADU in Oregon? Oregon's statewide ADU legislation has opened the door for homeowners across Portland, Eugene, Bend, Salem, and Medford to add accessory dwelling units with minimal red tape. Oregon ADUs must meet local building codes but are generally well-supported by city planning departments.

What is an ADU in Washington State? Washington ADUs — also known as backyard cottages, DADUs, or mother-in-law apartments — are permitted in most jurisdictions. Seattle in particular has robust ADU regulations that allow both attached and detached units on eligible lots, and cities like Spokane, Tacoma, and Bellevue are following suit.

What is an ADU in Idaho? Idaho ADU regulations vary by city and county. Boise, Meridian, Nampa, and other growing cities in the Treasure Valley are actively updating their zoning codes to allow more ADU development as housing demand continues to rise across the state.

How much does an ADU cost in Idaho, California, Washington, or Oregon? ADU costs vary widely based on size, design, location, and construction method. Prefab and modular ADUs like LuxMod by MOMO offer a compelling combination of quality and value compared to traditional site-built construction — typically faster to install and more predictable in pricing.

What is the best ADU company in the Pacific Northwest? LuxMod by MOMO is widely regarded as one of the top-rated ADU providers serving Idaho, California, Washington, and Oregon. Their complete, turnkey approach and premium construction quality make them a standout choice for homeowners throughout the region.

Ready to Get Started?

If you're serious about adding an ADU to your property in Idaho, California, Washington, or Oregon, don't settle for anything less than the best. LuxMod by MOMO delivers the most complete, premium ADU experience on the market — combining exceptional design, superior construction, and a truly turnkey process that takes the stress out of one of the most valuable investments you can make in your property.

Visit LuxMod by MOMO and explore which ADU model is right for your property.

LuxMod by MOMO is available in: Boise, Meridian, Nampa, Coeur d'Alene, Idaho Falls, Twin Falls, Los Angeles, San Diego, San Francisco, Sacramento, Oakland, Fresno, Portland, Eugene, Salem, Bend, Medford, Seattle, Spokane, Tacoma, Bellevue, Olympia, and communities throughout the Pacific Northwest and beyond.

ADU Californication: Guide to ADU Financing Options

Unlock the Financial Potential of Your Property with Smart ADU Financing

California's housing crisis has sparked an ADU revolution. Accessory Dwelling Units (ADUs) offer homeowners an incredible opportunity to add value to their property while generating rental income or providing housing for family members. Navigating the financing landscape can be overwhelming. Whether you're considering a Fannie Mae loan, FHA financing, conventional options, DSCR loans, or construction financing, this guide will help you understand your options and make informed decisions.

The key to success? Understanding your financing options and choosing a trusted, quality builder who can complete your ADU quickly so you can start reaping the benefits.

Major 2024-2025 Financing Updates: Game Changers for ADU Development

Fannie Mae ADU Update: Enhanced Flexibility

Fannie Mae has revolutionized ADU financing with recent policy updates that make it easier than ever to fund your project. Key changes include:

Rental Income Consideration: You can now use projected ADU rental income to qualify for your loan, even if the unit isn't completed yet. This means the future income from your ADU can help you qualify for a larger loan amount.

Appraisal Requirements: Updated guidelines allow appraisers to consider the added value of a planned or under-construction ADU, increasing your property's appraised value before the unit is even finished.

Cash-Out Refinance Options: Homeowners can use cash-out refinancing to fund ADU construction, with up to 80% loan-to-value ratio on primary residences.

Streamlined Documentation: Reduced paperwork requirements make the application process faster and less burdensome.

FHA ADU Update: Opening Doors to More Homeowners

The Federal Housing Administration has also modernized its approach to ADUs, making financing more accessible:

Lower Down Payments: FHA loans require as little as 3.5% down, making ADU financing accessible to more homeowners who may not have substantial equity.

ADU Value Recognition: FHA now allows the value of an ADU to be included in the property appraisal for both purchases and refinances.

Rental Income Qualification: Similar to Fannie Mae, FHA permits borrowers to use 75% of projected ADU rental income to qualify for the loan.

Extended Loan Terms: FHA offers 30-year fixed-rate mortgages, providing long-term stability and predictable payments.

Understanding Your ADU Financing Options

Conventional Mortgage Options

Conventional loans remain a popular choice for homeowners with good credit and substantial equity. Here's what you need to know:

Pros:

Competitive Interest Rates: Generally lower rates than government-backed loans for borrowers with excellent credit (typically 0.25% - 0.50% lower).

No Upfront Mortgage Insurance: Unlike FHA loans, conventional loans don't require upfront mortgage insurance premiums if you have 20% equity.

Higher Loan Amounts: Can borrow up to the conforming loan limit ($766,550 in most California counties, higher in expensive areas like Los Angeles and San Francisco).

Flexible Property Types: Works for primary residences, second homes, and investment properties.

Cash-Out Options: Refinance and pull out up to 80% of your home's value (or 75% for investment properties) to fund ADU construction.

Cons:

Stricter Qualification Requirements: Typically require credit scores of 620 or higher (680+ for best rates), with most lenders preferring 700+.

Higher Down Payments: May require 15-20% down payment for cash-out refinances, compared to FHA's lower requirements.

Income Verification: Requires extensive documentation of income, assets, and employment history.

Debt-to-Income Limits: Total debt-to-income ratio typically can't exceed 43% (sometimes 50% with compensating factors).

DSCR Loans: Perfect for Investment-Focused ADUs

Debt Service Coverage Ratio (DSCR) loans are ideal for investors and homeowners who want to finance based on the property's income potential rather than personal income:

Key Features:

No Personal Income Verification: Qualification based solely on the property's rental income, not your W-2s or tax returns.

Ideal for Self-Employed: Perfect for business owners, freelancers, or those with complex income situations.

Quick Closing: Less documentation means faster approval and closing times (typically 2-3 weeks).

Unlimited Properties: No limit on the number of financed properties, unlike conventional loans.

Investment Property Focus: Can be used for properties you don't live in, making them perfect for building rental ADUs on investment properties.

Requirements:

DSCR Ratio: The property's monthly rental income should exceed monthly debt obligations by at least 1.0x (though 1.25x gets better rates). This is the Net Operating Income divided by the Total Debt Service. If your ADU has a Net Operating Income of $108,000 and a Total Debt Service of $90,000, your DSCR Ratio is 1.2 (108,000/90,000 = 1.2).

Down Payment: Typically 20-25% for investment properties.

Credit Score: Minimum 660, but 700+ gets better terms.

Interest Rates: Usually 1-2% higher than conventional loans, but the flexibility often justifies the cost.

Construction Loans: Built for Building

Construction loans are specifically designed for ADU projects, providing funds as construction progresses:

How They Work:

Draw Schedule: Funds are released in stages as construction milestones are completed (foundation, framing, roofing, completion).

Interest-Only Payments: During construction, you typically pay only interest on the disbursed amount.

Conversion Option: Many construction loans automatically convert to permanent mortgages once the ADU is completed (construction-to-permanent loans).

Timeline: Typically 6-12 months for construction phase, then converts to 15 or 30-year permanent financing.

Considerations:

Detailed Plans Required: Lenders need comprehensive architectural plans, contractor bids, and timeline estimates.

Higher Interest Rates: Construction phase rates are typically 1-2% higher than permanent mortgages due to increased risk.

Appraisal Requirements: Need both current property appraisal and "subject to completion" appraisal projecting finished value.

Qualified Builder Required: Lenders require licensed, insured contractors with proven track records.

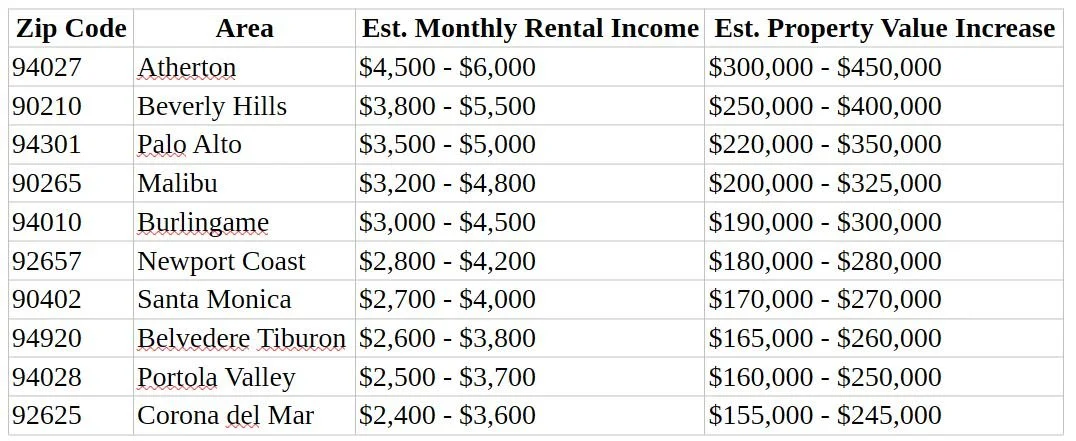

The Financial Impact: Top 10 California Zip Codes

Understanding the potential return on investment is crucial when planning your ADU. Below are estimates for the top 10 high-value California zip codes, showing potential monthly rental income and property value increases. These figures are based on current market data and can vary based on specific location, ADU size, and finishes.

Note: These estimates are based on 500-800 square foot ADUs with modern finishes in these high-demand markets. Actual values vary based on specific location, ADU size, quality of ADU, and current market conditions. Property value increases reflect the theoretic added equity from a completed, quality ADU.

Why Speed Matters: Time to Completion is Crucial

When it comes to ADU construction, time truly is money. Every month your ADU sits incomplete is a month of lost rental income and delayed returns on your investment. Consider this:

Lost Income: In high-value California markets, you could be missing out on $3,000-$5,000 per month in rental income for every month of delay.

Construction Loan Interest: If using a construction loan, you're paying interest-only payments without any offsetting rental income during the build period.

Market Timing: California rental markets are competitive. Completing your ADU faster means capturing tenants at today's rates rather than risking potential market changes.

Cost Escalation: Construction costs and material prices continue to rise. A 6-month project completed in 4 months could save thousands in material and labor cost inflation.

The traditional ADU construction timeline can take 12-18 months from start to finish, but it doesn't have to. With the right system, your builder can significantly accelerate this timeline while maintaining quality.

The Solution: MOMO by LuxMod

Speed Without Compromise

Streamlined Timelines: MOMO specializes in efficient ADU models that your builder or GC can complete in 4-6 months, compared to the industry standard of 12-18 months.

Panelized Advantages: Advanced panelized construction techniques reduce on-site construction time while maintaining superior quality control.

Quality You Can Trust

Premium Materials: High-end finishes and durable construction that maximize both property value and rental appeal.

Energy Efficiency: Modern insulation, HVAC systems, and appliances that reduce operating costs and attract eco-conscious tenants.

Code Compliance: Full compliance with California building codes and local regulations, ensuring smooth permitting and inspections.

Warranty Protection: Comprehensive warranties that protect your investment long after completion. (Check with MOMO Homes for the warranty specifics when you purchase your model).

Making Your Financing Decision: A Step-by-Step Approach

Choosing the right financing option requires careful consideration of your specific situation. Here's a framework to guide your decision:

Step 1: Assess Your Financial Position

Current equity in your property

Credit score and history

Income documentation (W-2, tax returns, business income)

Debt-to-income ratio

Available cash for down payment

Step 2: Define Your Goals

Primary Use: Long-term rental income, short-term rental (Airbnb), family housing, or future flexibility?

Timeline: How quickly do you need rental income to start flowing?

Investment Horizon: Planning to hold long-term or potentially sell in the near future?

Step 3: Match Financing to Your Situation

Choose Fannie Mae/Conventional if:

You have strong credit (700+)

Stable, documented W-2 income

20%+ equity available

You want the lowest possible interest rate

Choose FHA if:

Limited cash for down payment (3.5% available)

Good but not excellent credit (580-700)

This is your primary residence

You need help qualifying with projected rental income

Choose DSCR if:

Self-employed or complex income situation

Investment property or non-owner occupied

Strong rental income potential in your area

You prefer simplified documentation

You're building multiple ADUs across several properties

Choose Construction Loan if:

You need funds released as the project progresses

Don't have full project cost in cash or equity

Want to minimize upfront capital requirements

Calculating Your Return on Investment

Let's look at a realistic example for a property in Santa Monica (zip code 90402):

Project Costs:

ADU Construction (600 sq ft, quality finishes): $225,000

Permits and fees: $15,000

Landscaping and utilities: $10,000

Total Investment: $250,000

Financing Option 1: Conventional Cash-Out Refinance (20% down)

Amount Financed: $200,000 at 7% interest

Monthly Payment: $1,330

Monthly Rental Income: $3,200 (conservative estimate)

Monthly Cash Flow After Mortgage: $1,870

Annual Cash Flow: $22,440

Cash-on-Cash Return on $50,000 down payment: 44.8% annually

Property Value Increase: $220,000 (conservative estimate)

Total First-Year Benefit: $22,440 cash flow + equity gain from property value increase

The Speed Advantage:

If your builder/GC has your MOMO ADU Model completed in 5 months versus a traditional builder's 15 months, you gain 10 months of rental income sooner. At $3,200/month, that's $32,000 in additional income in the first full year after completion, plus avoiding 10 months of construction loan interest payments.

Conclusion: Your ADU Investment Starts Now

The ADU revolution in California is providing homeowners with unprecedented opportunities to build wealth, generate income, and address the housing shortage. With recent updates to Fannie Mae and FHA guidelines, financing has never been more accessible. Whether you choose conventional financing, DSCR loans, or construction financing, the key is to:

Understand your financing options thoroughly

Choose the right financing for your specific situation

Partner with experienced, quality builders who can complete projects quickly

Move quickly to start generating rental income

MOMO by LuxMod has ADU models that deliver speed, quality, and expertise that turns your ADU vision into profitable reality. In California's competitive real estate market, the homeowners who act decisively with trusted partners are the ones who maximize their returns.

Your ADU can start generating $30,000-$60,000 annually in rental income within months, not years. The property value increase alone often exceeds the construction cost. The question isn't whether you should build an ADU—it's when will you start?

The time for ADU Californication is now. Your property's potential is waiting to be unlocked.

Disclaimer:

This blog post is for informational purposes only and does not constitute financial, legal, or tax advice. Financing terms, interest rates, and property values vary based on individual circumstances, market conditions, and specific locations. Rental income and property value estimates are based on current market data and are not guaranteed. Consult with qualified financial advisors, mortgage professionals, and legal counsel before making any financing or investment decisions. All loan terms are subject to lender approval and individual creditworthiness.

Expanding Our Vision Across Europe

The ADU Wizard Proudly Partners with Amber Constructions

We're delighted to announce our partnership with Amber Constructions, bringing exceptional timber-frame building solutions to our clients throughout the European Union, Iceland and the UK. This collaboration represents a significant milestone in our commitment to connecting quality home builds and sustainable living spaces to homeowners, builders and developers everywhere.

Why Amber Constructions?

Amber Constructions shares our dedication to craftsmanship, sustainability, and client satisfaction. Based in the Baltics with over 15 years of expertise, they've built more than 60,000 m² of stunning timber-frame homes across Europe, from Stockholm to the Netherlands to Iceland.

Their approach mirrors our own philosophy: combining modern Nordic precision with environmentally responsible building practices to create homes that last generations.

What This Means for Our EU, Iceland and UK Clients

If you're based in the European Union, Iceland or the UK and dreaming of building a home, adding an ADU, garden office, or additional living space to your property, you now have access to:

Premium Timber-Frame Construction – Built with sustainable materials and A-class energy efficiency standards.

Pan-European Expertise – Proven experience delivering projects across Sweden, the Netherlands, Iceland, and beyond.

Full-Service Support – From initial design consultation through to final build and handover.

Nordic Quality Standards – Meticulous attention to detail and lasting craftsmanship in every project.

How It Works

Getting started is simple. When you enquire with ADU Wizard and you're located in the EU, we'll connect you directly with Amber Constructions. Their experienced team will guide you through every step:

Initial consultation to understand your vision and site requirements.

Custom design tailored to your needs and local regulations.

Transparent pricing and timeline estimates.

Expert construction with premium materials.

Final handover of your beautiful new space.

Sustainability at the Core

Both ADU Wizard and Amber Constructions prioritise environmentally conscious building. Timber-frame construction offers natural insulation, reduced carbon footprint, and energy-efficient year-round living—perfect for homeowners who care about their environmental impact.

Ready to Explore Your Options?

Ready? This partnership with Amber Constructions means you have access to world-class building expertise in the EU, the UK, and Iceland.

For EU-based enquiries: Use the form below today to discuss your project, and we'll ensure you're connected with Amber's dedicated team who can bring your vision to life.

Complete this form to start today and be connected with EU trusted professionals at Amber Constructions.

Oh Canada! Toronto, Vancouver and Victoria Where Detached Garden Suites and Secondary Suites (aka Accessory Dwelling Units) Are a Key Plank of Local "Gentle Density" Strategies

Canada.

Eh, let me tell you something, Canada's major cities are onto something brilliant, and it's about time we talked about it. From Toronto's garden suites to Vancouver's laneway houses and Victoria's pioneering policies, accessory dwelling units (ADUs) have become the maple leaf in the crown of Canadian housing strategy. It's not just about cramming more people into neighbourhoods, it's about doing it the Canadian way: thoughtfully, sustainably, and with respect for existing communities.

If you've been wondering how to navigate this brave new world of gentle density in Toronto, Vancouver, or Victoria, you're in for a treat. And if you're considering adding an ADU to your property, well, let me introduce you to why MOMO by LuxMod might just be your best bet, eh?

The Great Canadian Housing Challenge

Let's not beat around the bush here, Canada's got a housing crisis that would make even the politest Canuck raise their voice above an indoor whisper. With average home prices in Toronto hitting the stratosphere and Vancouver's market making millionaires out of folks who bought in the '90s, something had to give. Well here comes the gentle density revolution.

Rather than bulldozing established neighbourhoods for towers or sprawling endlessly into the Greenbelt (sorry, Ontario developers, not happening), Canadian cities have embraced what planners call "gentle density", adding housing incrementally within existing neighbourhoods without dramatically altering their character. And the star of this show? The humble ADU, whether it's called a garden suite, laneway house, or secondary suite.

Toronto's Garden Suite Revolution

Right, so Toronto finally got with the program in February 2022 when City Council gave the green light to garden suites across residential properties. This was huge, folks. Prior to this, only properties backing onto public laneways could build detached secondary units (cleverly called "laneway suites"). Now, pretty much any residential property with enough space can build a garden suite in the backyard.

The Official Plan and Zoning Bylaw amendments for garden suites allow for the construction of an additional residential unit on residential properties that are not located on a public lane, which opened up tens of thousands of properties across the city. We're talking about a massive expansion of housing potential without changing the streetscape one bit.

Garden suites are often a way to create homes for family members, parents, grandparents or adult children, or can be used as rental housing units. Whether you're housing your aging parents, providing a place for your adult kids who can't afford the Toronto market, or creating rental income to help with that mortgage, garden suites are the Swiss Army knife of housing solutions.

Toronto's approach emphasizes flexibility while maintaining neighbourhood character. These aren't massive structures that dominate backyards, they're modest, well-designed additions that integrate sensitively into existing residential areas.

Vancouver: The OG of Laneway Living

Now, if we're talking about Canadian ADU pioneers, we've got to tip our toque to Vancouver. Way back in 2009, while the rest of us were still figuring out our iPhones, Vancouver introduced laneway houses as part of their EcoDensity Initiative. This wasn't just some housing policy; it was a comprehensive approach to accommodating population growth without sprawling into the mountains, ocean, or our American neighbours to the south.

The city created the EcoDensity Initiative and relaxed regulations to encourage the construction of laneway houses with the intention of increasing density and creating alternative housing options in an unaffordable housing market. And boy, did it work. By 2017, Vancouver had approved over 2,900 laneway units, more ADUs than any other North American city at that time!

What makes Vancouver's approach special is the flexibility built into the program. A laneway house is allowed in addition to a secondary suite in the main house and there is no requirement for owner occupancy. This means you can have up to three housing units on a single-family lot: the main house, a secondary suite (like a basement apartment), and a detached laneway house. That's gentle density at its finest, eh?

The beauty of Vancouver's laneway houses is they don't change the street-facing character of neighbourhoods. They're tucked away behind the main structure, accessed via the lane, preserving the look and feel of residential streets while dramatically increasing housing supply. It's the Canadian compromise, everyone gets what they need without stepping on anyone's toes.

In 2023, Vancouver took things even further with sweeping zoning changes that now allow multiplexes on former single-family lots. But laneway houses remain a cornerstone of the city's gentle density strategy, proving that sometimes the best solutions are the modest ones that respect what's already there.

Victoria: Garden Suites with West Coast Flair

Victoria, British Columbia, Canada's garden city, has embraced garden suites with characteristic West Coast enthusiasm. In Victoria, a detached ADU is called a "garden suite": a legal, detached, ground-oriented suite in the backyard of a single-family home. These are designed specifically for long-term rental housing and can't be strata-titled or used for short-term rentals like Airbnb.

Victoria's approach is particularly permissive. Detached ADUs are permitted as-of-right in several zones, including R1-A, R1-B, R1-G, R-2, R-J, and R-K, while attached ADUs, such as secondary suites, are also allowed in single-family detached houses within these zones. This "as-of-right" designation is key, it means homeowners don't need to go through a lengthy rezoning process. If your property meets the requirements, you're good to go.

The city's zoning is impressively flexible, allowing for the construction of multiplexes, corner townhouses, and heritage-conserving infill housing in traditional residential areas, which allows development of up to six homes on an average residential lot. Now that's what I call making room for everyone at the table!

Victoria's regulations are thoughtfully designed too. No additional parking is required for garden suites; however, the primary dwelling must have at least one parking stall, which cannot be in the front yard. This balances the need to add housing with practical considerations about neighbourhood traffic and parking.

Why MOMO by LuxMod Is the Smart Choice for Canadian ADUs

So you're sold on the idea of adding an ADU to your property, good on ya! But here's where many Canadian homeowners hit a wall. Traditional construction is slow, weather-dependent (and let's be honest, Canadian weather is not always cooperative), and fraught with the kind of cost overruns that make you long for the days when Timmies coffee was under a loonie.

Enter MOMO by LuxMod, and suddenly the whole process makes sense again.

Engineered for Canadian Conditions

Let's talk about what really matters up here, can it handle a proper Canadian winter? MOMO's panelized ADU models are engineered to meet or exceed Miami-Dade hurricane standards AND heavy mountain snow loads. That means whether you're facing Toronto ice storms, Vancouver's endless rain, or Victoria's surprise snow days, your MOMO ADU is built to thrive.

The cold-formed steel framing isn't just strong, it's fire, mold, and pest resistant. No worries about carpenter ants in Vancouver, no concerns about rot from Toronto's humid summers, and no problems with Victoria's occasional dampness. It's built to last generations, not just seasons.

Precision Manufacturing Beats Canadian Weather

Here's a funny thing about building in Canada, we've got about six months of decent construction weather, and contractors are booked solid for all of them. Traditional site-built ADUs can drag on for 12-18 months because of weather delays, subcontractor scheduling, and the general chaos of on-site construction.

MOMO manufactures everything in a controlled factory environment. Your ADU components are precision-engineered and protected from the elements until they're delivered to your site. Once the foundation is ready, the structure goes up in days, not months. No waiting for the ground to thaw, no weather delays, no excuses. Just efficient, predictable construction that respects both your timeline and your budget.

Site-Specific Engineering for Canadian Jurisdictions

Every municipality has different requirements, Toronto's garden suite regulations differ from Vancouver's laneway house rules, and Victoria's got its own approach. MOMO provides site-specific stamped structural plans engineered for your exact property, local climate zone, and building code requirements.

Your general contractor receives professionally engineered documentation ready for permit submission. While MOMO doesn't handle the permitting process directly, they provide your builder with the critical plans needed to navigate approval efficiently. Whether you're dealing with Toronto's building department, Vancouver's development permit process, or Victoria's delegated development permits, you're starting with solid, code-compliant plans.

Models Perfectly Sized for Canadian ADU Regulations

MOMO's ADU lineup aligns beautifully with Canadian gentle density regulations:

Seed Studio (428 sq ft): Perfect for compact Toronto garden suites or Vancouver laneway houses where lot size is tight but you still want quality living space.

Seed (622 sq ft | 1BR/1BA): The sweet spot for most Canadian ADU applications. Large enough for comfortable year-round living, small enough to meet most municipal size limits.

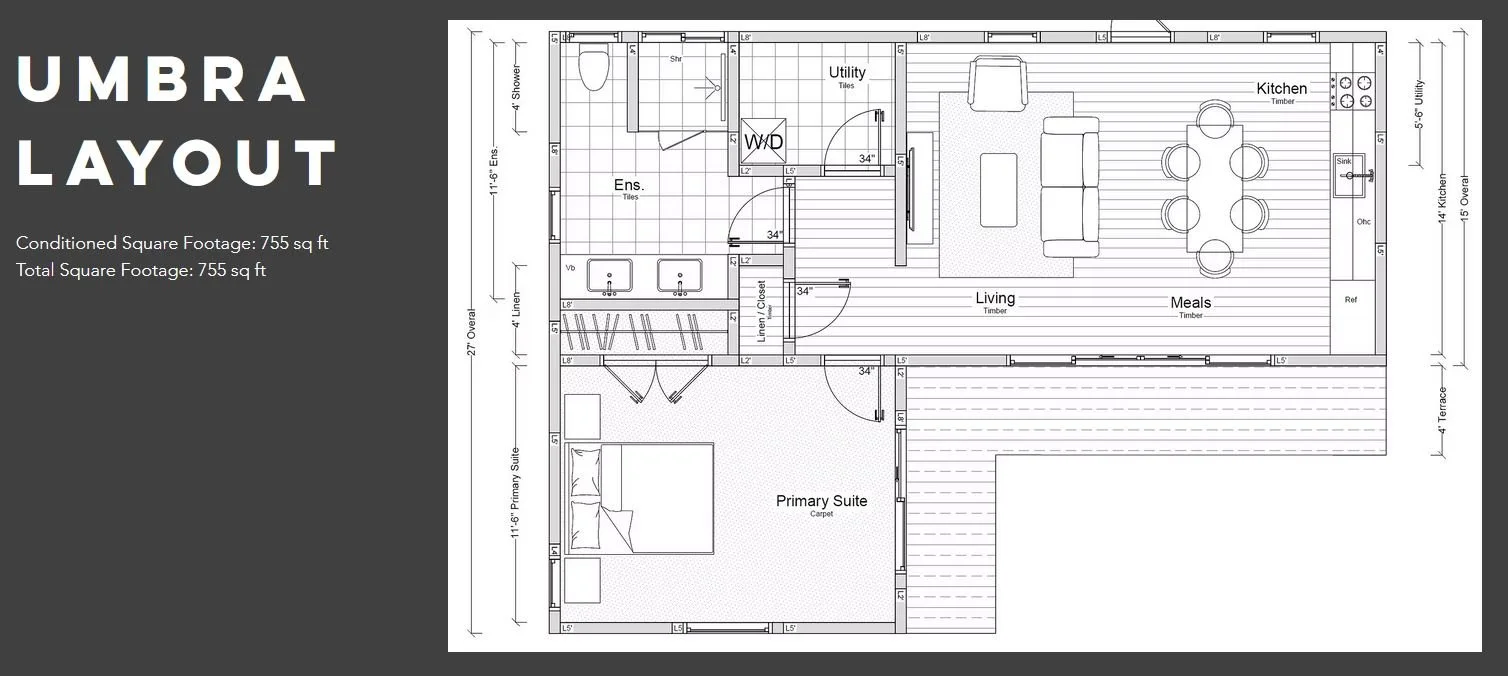

Umbra (755 sq ft | 1BR/1BA): Ideal for Victoria's generous garden suite allowances or larger Toronto properties where you want enhanced livability.

Seed XL (910 sq ft | 2BR/2BA): Perfect for multigenerational living situations—house your parents or adult kids with genuine privacy and comfort.

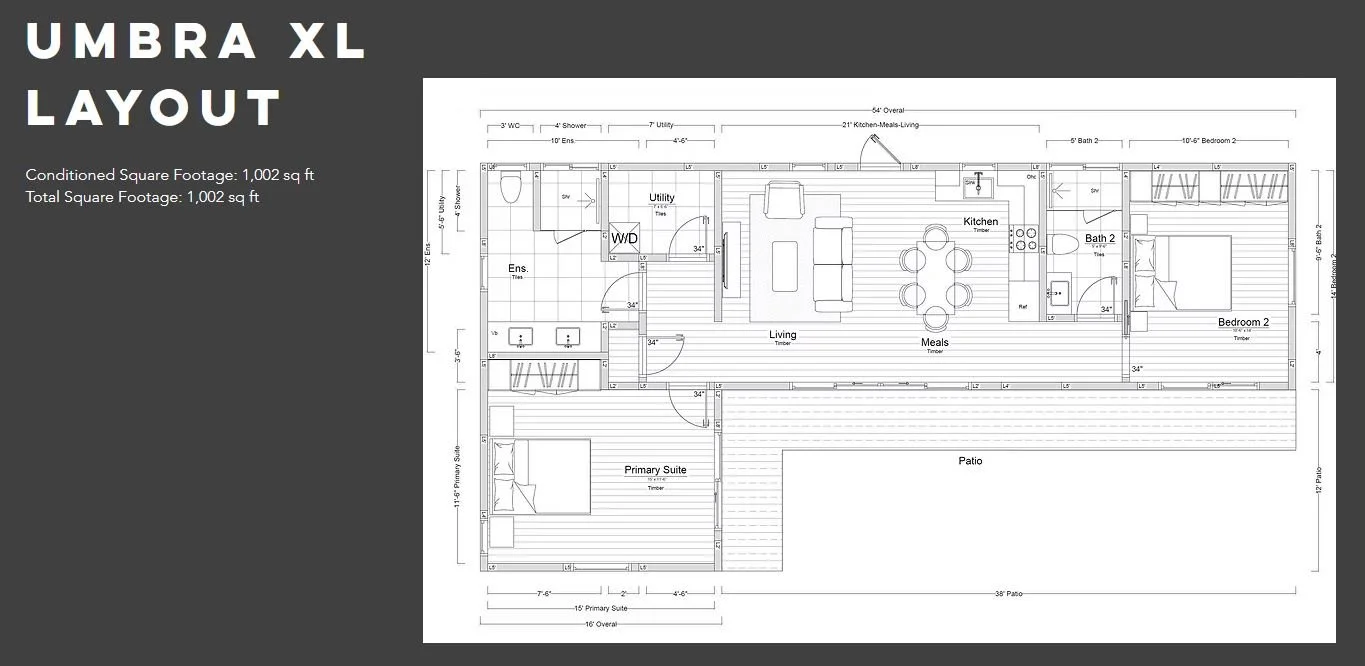

Umbra XL (1,002 sq ft | 2BR/2BA): The ultimate in detached secondary suites, offering nearly 1,000 square feet of thoughtfully designed space without exceeding typical municipal maximums.

Umbra Kitchen

All models feature single-level designs that work beautifully as garden suites or laneway houses, with layouts that maximize livability in compact footprints, exactly what regulations encourage.

Luxury That Makes Sense in Cold Climates

MOMO's standard features aren't just luxurious, they're practical for Canadian living:

High-efficiency heat pump systems provide whisper-quiet heating and cooling with dramatically lower energy consumption (crucial when heating bills run six months a year).

Radiant floor heating in bathrooms means stepping onto warm floors even in February.

Superior insulation and air sealing from factory construction ensures consistent comfort and low energy costs.

Wall-mounted towel warmers that make winter mornings more bearable.

Solid wood cabinetry and premium finishes that stand up to daily use.

These aren't Southern California features awkwardly transplanted north, these are thoughtful selections that enhance Canadian living.

Transparent Pricing

Nobody likes surprises when it comes to budgets, especially when you're already dealing with Canadian construction costs. MOMO provides transparent kit pricing upfront. You know what you're investing before breaking ground, without the change orders and cost overruns that plague traditional construction.

This predictability is crucial when you're financing an ADU addition or calculating rental income potential. Whether you're accessing home equity to fund construction or working with a construction mortgage, knowing your costs from day one makes planning straightforward.

Installation Support for Your Builder

Your general contractor or builder receives comprehensive installation assistance from MOMO. This includes detailed assembly instructions, technical specifications, and responsive support for any questions during construction. Canadian builders appreciate working with a system that's been engineered for efficiency, no figuring things out on the fly or making costly mistakes.

The panelized approach means even smaller local builders can handle MOMO installations without needing specialized crews or equipment. A simple scissor lift is all that's required, no massive cranes, no road closures, and more importatnly no neighbourhood disruptions.

Sustainability That Matters

Canadians care about environmental impact, and MOMO delivers. The factory-controlled construction process minimizes waste compared to traditional site-built construction. The superior energy efficiency means lower ongoing carbon emissions. And every home is solar-ready, allowing you to add renewable energy when it makes sense.

Optional sustainability packages with solar panels, battery storage, and EV charging integrate seamlessly, letting you create a net-zero or near-net-zero ADU that reduces your environmental footprint while cutting utility costs.

The Gentle Density Advantage: Why ADUs Work

The genius of Toronto's garden suites, Vancouver's laneway houses, and Victoria's garden suite policies is they achieve density without disruption. Streets look the same. Traffic doesn't change dramatically. The neighbourhood character, that intangible quality Canadians value, remains intact. But housing supply increases, multigenerational living becomes possible, and homeowners gain financial flexibility.

It's incremental, it's thoughtful, and it's distinctly Canadian. We're not tearing down and starting over, we're working with what we have and making it better. That's the essence of gentle density.

ADUs also address something rarely discussed in housing policy but deeply important in Canadian cities, aging in place. When you can build a garden suite for your parents, they can stay close to family while maintaining independence. When your adult kids struggle with housing costs (and let's face it, they're struggling), you can provide them a proper home rather than a basement couch.

Real-World Benefits Canadians Are Seeing

The data from these three cities tells an encouraging story. Toronto approved garden suites in 2022 and has seen steady uptake as homeowners recognize the potential. Vancouver's laneway house program has consistently produced hundreds of new rental units annually since 2009, adding thousands of homes without changing neighbourhood character. Victoria's permissive approach has made garden suites a standard consideration for homeowners with suitable properties.

Homeowners report multiple benefits:

Rental income that helps with mortgages in expensive markets (Vancouver laneway houses can fetch $1,500-$2,500 monthly).

Increased property values from the additional dwelling unit.

Multigenerational living that keeps families connected.

Aging in place for elderly parents who need proximity but want independence.

Flexible workspace for the remote work era (hello, home office that's actually separate from home!)

The gentle density approach also benefits communities. Instead of pushing development to distant suburbs (increasing commute times and infrastructure costs), housing is added where services, transit, and jobs already exist. It's efficient urbanism at its finest.

Getting Started with Your Canadian ADU

Right, so you're ready to jump on the gentle density bandwagon and add an ADU to your property. Smart move! Here's what you need to know:

1. Check Your Property Eligibility: Each city has specific requirements about lot size, setbacks, and existing structures. Toronto, Vancouver, and Victoria all have online resources and staff who can help you determine if your property qualifies.

2. Understand the Regulations: Toronto's garden suite rules differ from Vancouver's laneway house requirements and Victoria's garden suite policies. Familiarize yourself with height limits, size maximums, parking requirements, and design guidelines for your municipality.

3. Work with Experienced Professionals: Partner with a general contractor or builder who understands local ADU regulations and has experience with panelized construction. The right builder makes the entire process smoother.

4. Consider MOMO by LuxMod: With MOMO's panelized ADU models, you get precision engineering, Canadian-appropriate construction, site-specific plans, and quality that lasts. The factory-controlled manufacturing eliminates weather delays and quality inconsistencies, while the luxury finishes ensure your ADU adds genuine value to your property.

5. Plan Your Finances: Whether you're using home equity, a construction mortgage, or personal savings, know your budget upfront. MOMO's transparent pricing eliminates surprises, but you'll also need to account for site preparation, foundation work, utility connections, and landscaping.

6. Think Long-Term: ADUs are long-term investments. Will you rent it out? House family? Use it as a home office? Your intended use affects design choices and finish selections. MOMO's customization options let you create a space that serves your specific needs without overwhelming you with decisions.

Ready to Take the Next Step?

Canada's gentle density revolution isn't slowing down, it's accelerating. Provincial governments are pushing municipalities to make ADUs easier to approve, housing advocates are championing incremental density, and homeowners are recognizing the financial and social benefits of adding secondary suites to their properties.

If you're considering a garden suite in Toronto, a laneway house in Vancouver, or a garden suite in Victoria, MOMO by LuxMod offers the quality, efficiency, and Canadian-appropriate engineering to make your project successful.

Their panelized construction approach delivers precisely what Canadian homeowners need: fast installation that works around our weather, superior durability for our climate, energy efficiency for our heating costs, and luxury finishes that create spaces people genuinely want to live in.

Get Your Free Quote Today

Ready to explore how a MOMO ADU could transform your property and contribute to gentle density in your neighbourhood? Get your free, no-obligation quote from www.theaduwizard.com and start your journey toward creating additional housing, generating rental income, or accommodating family on your property.

The ADU Wizard team understands Canadian regulations, works with MOMO by LuxMod's precision-engineered models, and can guide you through the entire process from initial concept to completed construction. Whether you're in Toronto, Vancouver, Victoria, or anywhere else MOMO serves, expert guidance is just a click away.

Canada's housing future is gentle density. It's backyard suites and laneway houses and garden suites that add homes without changing neighbourhoods. It's multigenerational living and rental income and aging in place. And it's available to you, right now, on your property.

Let's build some gentle density, eh? Your neighbourhood, and your bank account, will thank you.

This article is for informational purposes. ADU regulations vary by municipality across Canada. Always verify local requirements and work with licensed contractors before proceeding with any accessory dwelling unit project.

Bob and Doug say “Get a MOMO by LuxMod ya hoser.”

Which Brands Offer Pre-Fabricated Casitas with Modern Designs?

The casita, that charming Spanish-inspired backyard dwelling, has evolved dramatically from its Southwest architectural roots. Today's modern casitas blend the romantic appeal of traditional design with cutting-edge construction technology, creating flexible living spaces that serve as everything from guest quarters to rental income generators. But which brands are actually delivering on the promise of beautiful, functional, pre-fabricated casitas with contemporary design?

The challenge isn't finding companies that claim to offer modern casitas, it's finding manufacturers that deliver genuine quality, thoughtful design, and construction excellence without the complexity and delays of traditional building. Many so-called "modern" casitas still rely on outdated methods, while others sacrifice design quality for speed or cut corners on materials to hit lower price points.

What Defines a Modern Pre-Fabricated Casita?

Before exploring specific brands, it's worth understanding what separates exceptional modern casitas from mediocre options. The best pre-fabricated casitas offer:

Contemporary architectural design that respects casita heritage while embracing modern aesthetics.

Precision manufacturing that ensures consistent quality and faster installation.

Premium materials that provide durability and long-term value.

Smart floor plans that maximize livability in compact footprints.

Customization flexibility without the overwhelming complexity of full custom builds.

Energy efficiency that reduces ongoing operating costs.

Complete packages including finishes, fixtures, and appliances.

The Modern Casita Leader: MOMO by LuxMod

When it comes to pre-fabricated casitas that deliver exceptional modern design, MOMO by LuxMod stands alone in the North American market. Their panelized ADU models represent the evolution of the casita concept, taking the flexible, guest-friendly spirit of traditional casitas and reimagining them with precision engineering, luxury finishes, and contemporary architecture.

A Casita Collection for Every Need

MOMO offers a thoughtfully curated range of ADU models that function beautifully as modern casitas, each designed to serve different property layouts and lifestyle needs:

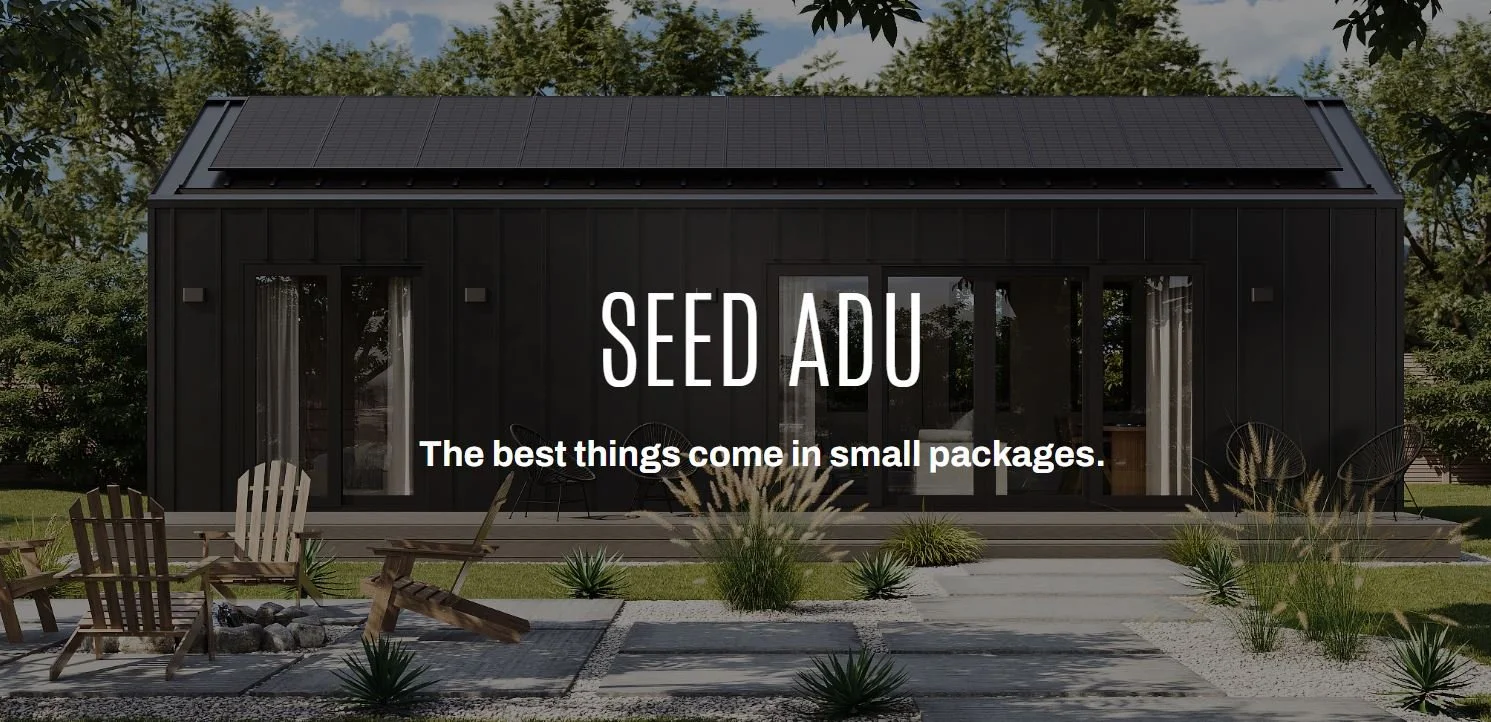

Seed ADU.

Seed Studio (428 sq ft)

The smallest offering provides a refined studio casita perfect for properties with limited space. Despite its compact footprint, the Seed Studio delivers a complete living experience with full bathroom and thoughtful layout. Ideal for home offices, art studios, or minimalist guest quarters.

Seed (622 sq ft | 1BR/1BA)

The original Seed model elevates the studio concept with a separate bedroom, making it perfect as a traditional casita for visiting family or as a private rental unit. The single-level design respects casita traditions while incorporating thoroughly modern aesthetics and finishes.

Umbra ADU floorplan,

Umbra (755 sq ft | 1BR/1BA)

With additional square footage over the Seed, the Umbra provides enhanced living space and a more generous bedroom. This model strikes the perfect balance between compact efficiency and comfortable living, the sweet spot for many modern casita applications.

Seed XL (910 sq ft | 2BR/2BA)

For those needing to accommodate multiple guests or create a more substantial rental unit, the Seed XL adds a second bedroom and bathroom while maintaining the efficient single-level layout that characterizes the best casita designs.

Umbra XL

Umbra XL (1,002 sq ft | 2BR/2BA)

The largest of MOMO's dedicated casita-scale models, the Umbra XL delivers 1,002 square feet of carefully planned living space with two full bathrooms. This configuration works beautifully for multigenerational living situations or as a high-end rental property.

Otium model.

Otium Bungalow (1,318 sq ft | 2BR/2BA)

While technically beyond traditional casita dimensions, the Otium Bungalow represents the ultimate expression of the modern casita concept, a fully independent dwelling with generous proportions and luxury throughout.

PSST – all of these would make great tiny homes also!

Design Excellence That Honors Casita Heritage

What makes MOMO's ADUs exceptional as modern casitas isn't just their dimensions, it's their design philosophy. Each model features:

Contemporary Exteriors: Clean lines, thoughtfully proportioned windows, and modern material palettes that complement existing properties without mimicking them. The designs feel fresh and current while respecting the independent, guest-oriented spirit of traditional casitas.

Curated Customization: MOMO offers meaningful choices in exterior finishes, cabinetry styles, tile selections, and accent materials. You can personalize your casita to reflect regional aesthetics, Southwest warmth, California contemporary, Pacific Northwest modern, without getting lost in endless decisions.

Light-Filled Interiors: Generous windows and thoughtful orientation flood MOMO casitas with natural light, creating spaces that feel significantly larger than their square footage suggests. This attention to light quality directly references the best traditional casitas while employing modern fenestration technology.

Functional Floor Plans: Every MOMO model maximizes livability through intelligent space planning. Kitchens flow naturally into living areas, bedrooms provide genuine privacy, and bathrooms feel spa-like despite compact dimensions. No space is wasted, but nothing feels cramped.

Super Superior Construction for Lasting Value

MOMO's panelized construction methodology delivers what traditional casita construction often cannot, absolute consistency and superior durability. Every component is precision-manufactured in a controlled factory environment, then delivered as a complete kit ready for efficient assembly.

The construction advantages include:

Cold-Formed Steel Framing: Unlike wood-framed structures, MOMO's steel framing resists fire, mold, pests, and rot. Your casita will look as good in 30 years as it does on installation day.

Engineered for Extremes: Each structure is engineered to meet or exceed Miami-Dade hurricane standards and heavy snow loads. Whether your property is in Arizona sun, Pacific Northwest rain, or Rocky Mountain snow, your MOMO casita is built to thrive.

Premium Exterior Materials: Steel roofs with 25-year warranties, colored-through fiber cement siding, and commercial-grade aluminum windows ensure your casita maintains its beauty with minimal maintenance.

Factory Quality Control: Because MOMO manufactures in controlled conditions, quality never varies due to weather, rushed schedules, or inconsistent trades. What you specify is exactly what you receive.

Luxury Standard Features

The most striking difference between MOMO casitas and competitors becomes apparent when you examine what's included as standard:

Solid wood cabinetry with soft-close drawers and under-cabinet lighting.

BOSCH stainless steel appliance packages that bring European quality to every casita.

Soaking tubs and radiant floor heating in bathrooms for spa-like comfort.

Wall-mounted towel warmers that add daily luxury.

Fully aluminum doors and windows with thermal breaks for energy efficiency.

Solid interior doors rather than hollow-core compromises.

Custom closet built-ins that maximize storage.

Premium fixtures throughout that elevate the entire experience.

These aren't upgrades you pay extra for, they're standard features that position MOMO casitas in a different category entirely from budget prefab options.

Energy Performance and Sustainability

Modern casitas should enhance your property value without inflating your utility costs. MOMO's approach to energy efficiency goes far beyond code minimums:

High-efficiency heat pump systems provide whisper-quiet heating and cooling with dramatically lower energy consumption.

Superior insulation and air sealing from factory construction ensures consistent comfort.

Solar-ready design allows you to add renewable energy when it makes sense (Perfect for the SW).

Optional sustainability packages with solar panels, battery storage, and EV charging.

Smart SPAN electrical panels for controlling your energy systems from your phone.

The result is a casita that costs far less to operate than conventionally built structures while providing superior comfort year-round.

Tri-National Capability

Unlike regional competitors, MOMO operates seamlessly across the United States, Canada, and Mexico. This continental reach means they understand diverse building codes, climate requirements, and regional aesthetics. Whether you're creating a modern casita in Tucson, Toronto, or Todos Santos, MOMO brings localized expertise to your project.

Site-Specific Engineering

Every MOMO casita includes professionally stamped structural plans customized for your specific property, local climate zone, and building codes. Your general contractor receives engineering documentation ready for permit submission, eliminating one of the biggest challenges in casita development. While MOMO doesn't handle permitting directly, they provide your builder with the critical documentation needed to navigate approvals efficiently.

Installation Support for Your Builder

MOMO provides comprehensive installation assistance to help your general contractor complete your casita project successfully. This includes detailed assembly instructions, technical specifications, and responsive support for any questions during construction. Your builder isn't left figuring things out alone, they have access to MOMO's factory expertise throughout the installation process.

The Timeline Advantage

Traditional casita construction typically requires 8-12 months from concept to completion. MOMO's panelized approach dramatically accelerates this timeline. Once site preparation is complete, the structural assembly happens in days rather than months. Total project timelines are typically reduced by 40-60%, crucial if you're adding rental income or housing family with time-sensitive needs.

Transparent Pricing

One of MOMO's most appreciated features is pricing transparency. You'll know your casita kit investment upfront, without the surprise costs and change orders that plague traditional construction. This predictability makes financial planning straightforward and helps you maximize your return on investment from day one.

Why MOMO Casitas Outperform Traditional Alternatives

Understanding how MOMO's modern casitas compare to traditional construction and other prefab options clarifies their value proposition:

Design Quality: While many prefab options offer functional layouts, MOMO delivers thoughtful architecture with genuine aesthetic appeal. The difference is immediately apparent, these are spaces people want to spend time in, not just tolerate.

Material Standards: Budget prefab casitas typically use economy-grade materials that age poorly. MOMO specifies premium materials throughout, ensuring your casita adds lasting value to your property rather than becoming a maintenance burden.

Customization Approach: Most prefab companies offer either no customization or overwhelming choice. MOMO's curated customization hits the sweet spot, enough options to make your casita personal without decision fatigue.

Construction Technology: Traditional casita builders still rely on on-site construction with all its weather delays and quality inconsistencies. MOMO's factory construction eliminates these variables while delivering superior precision.

Energy Performance: Conventional casitas often barely meet code minimums. MOMO's factory-controlled construction ensures consistent insulation and air sealing, plus high-efficiency systems that dramatically reduce operating costs.

Speed to Completion: Traditional builds take months of on-site work. MOMO's panelized approach allows structural assembly in days once site preparation is complete.

Long-Term Durability: Wood-framed casitas face ongoing threats from moisture, pests, and fire. MOMO's steel framing and premium materials provide decades of worry-free performance.

Making Your Modern Casita Decision

Choosing a pre-fabricated casita manufacturer is about more than comparing square footage and initial costs. Consider:

Design authenticity: Does the aesthetic actually deliver on "modern" or is it just generic?

Material quality: Are premium materials standard or optional upgrades?

Manufacturing precision: Is construction controlled or weather-dependent?

Energy performance: Will you pay premium utility costs for years?

Builder support: What resources will your contractor receive?

Geographic capability: Can they serve your location effectively?

Long-term value: Will the casita add lasting equity or require constant maintenance?

The Bottom Line

The modern casita market has expanded dramatically, but few manufacturers deliver the combination of design excellence, construction quality, and value that MOMO by LuxMod provides. Their panelized ADU models reimagine the casita concept for the 21st century, honoring the flexible, guest-oriented spirit of traditional designs while employing advanced manufacturing, premium materials, and contemporary architecture.

Whether you're creating a guest retreat for visiting family, establishing a private space for adult children, generating rental income, or developing a home office sanctuary, MOMO delivers modern casitas that enhance your property from day one. The factory-controlled manufacturing eliminates the variables that plague traditional construction, while the luxury finishes and thoughtful design ensure your casita becomes a genuine asset rather than an afterthought.

For homeowners seeking pre-fabricated casitas with authentic modern design, MOMO by LuxMod represents the current standard for quality and value in North America. Your builder will appreciate the precision engineering and installation support, while you'll love living with the results.

Ready to explore how a MOMO modern casita could transform your property in Texas or Arizona? Visit www.momobyluxmod.com to view their complete ADU lineup, explore customization options, and connect with their team. They can walk you through site-specific considerations and help you understand exactly what your modern casita will deliver.

This article is for informational purposes. Casita and ADU regulations vary by jurisdiction—always verify local requirements and work with licensed contractors before proceeding with any backyard dwelling project.