How much value will an ADU add to my property, and is it a good investment in San Diego’s market?

How Much Value Does an ADU Add in San Diego?

Properties with legal, permitted ADUs in San Diego sell for 25–35% more on average than comparable homes without ADUs.

In dollar terms, many San Diego homeowners see $200,000 or more in added value after completing an ADU, with some reports of smaller units costing about $200,000 and yielding $300,000 in increased equity.

National data backs this up: California homes with ADUs often sell for up to 35% above similar homes without, according to the National Association of Realtors.

Is an ADU a Good Investment?

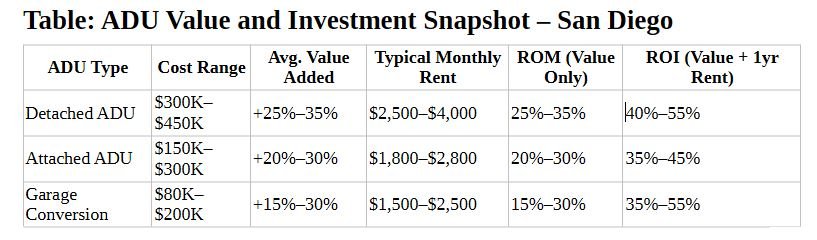

Rental Income Potential: ADUs typically rent for $1,900–$3,700 per month, depending on size and location (studios to 2-bed units).

ROI and Payback: Typical ROI (return on investment) for detached ADUs in San Diego is estimated at 25%–35% just from value added, and 40%–55% when first-year rental income is included.

Strong Demand: Homes with ADUs often sell faster, up to a month sooner, due to higher buyer interest from both investors and multi-generational families.

Long-term Appreciation: Properties with ADUs appreciate at about 9.3% annually, outpacing homes without ADUs which average 7.7%.

Versatility: An ADU can be used for rental, home office, guest housing, or family, adding flexibility and market appeal.

Rental Income Example: A well-located 2-bedroom ADU renting for $3,000/month can gross $36,000/year, easily offsetting financing payments and generating positive cash flow.

Factors That Influence Value Added

Size, Design, and Quality: Larger, well-finished units tend to add more value. (MOMO Homes by LuxMod is a strong contender as the come complete with high end finishes and include all appliances!)

Neighborhood and Demand: ADUs built in high-demand areas or near transit and jobs generally see the strongest returns.

Permitting: Only properly permitted ADUs unlock full market value; unpermitted units may not be counted by appraisers or buyers and can cause headaches!

Rental Strategy: Long-term rentals deliver steady income, while short-term rentals (where allowed) can further boost ROI.

Table: ADU Value and Investment Snapshot – San Diego

Conclusion:

Building an ADU in San Diego can boost your property’s value by up to 35%, or more, provide strong ROI and deliver reliable rental income. For many local homeowners, an ADU is a smart investment with lasting benefits for equity, flexibility, and resale potential, especially in one of California’s most competitive housing markets.

Sources:

https://www.blockrenovation.com/guides/how-much-value-does-an-adu-add-in-california-markets

https://waymakerca.com/blog/how-adus-impact-san-diego-home-value-and-resale

https://www.kbbeyond.com/post/how-profitable-are-adus-profit-potential-from-an-adu-in-san-diego

https://www.housetohome.com/what-value-does-an-adu-add-for-your-home-in-san-diego/

https://snapadu.com/blog/roi-adu-good-investment-valuation-appraisals/

https://streamlinedesigngroup.com/blog/garage-adu-conversion-cost