Why ADUs and STRs Are Still a Winning Investment Strategy for 2026

The short-term rental market is evolving, and smart investors are adapting their strategies. While traditional vacation rental markets face increased competition and regulatory scrutiny, a strategic opportunity remains strong: combining new construction accessory dwelling units (ADUs) with short-term rentals in markets where regulations allow it. With innovative solutions like MOMO by LuxMod's modern panelized ADUs, property owners can capitalize on this lucrative intersection of real estate investment in 2026 and beyond.

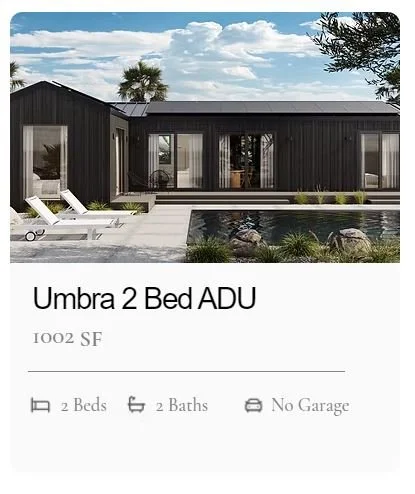

Umbra ADU Model.

The STR Market Reality: Not Dead, Just Different

Despite headlines suggesting otherwise, the short-term rental sector remains robust in specific markets. Industry forecasts indicate 2026 will be one of the best years to invest in STRs since 2021, driven by slowing supply growth, strengthening pricing power, and major demand drivers like the 2026 FIFA World Cup.

The key difference? Success now requires strategic market selection and professional execution. The days of passive income from any property listed on Airbnb are over, but well positioned STRs in the right locations continue to deliver impressive returns.

Where ADUs Can Legally Generate STR Income

CRITICAL: Always verify current local regulations before investing. Short-term rental laws change frequently and vary significantly by jurisdiction. The markets listed below have historically allowed or shown openness to STR use of ADUs, but you must confirm current rules with local authorities.

High-Opportunity Markets for ADU Short-Term Rentals

Florida Markets: Florida's state law prohibits municipalities from banning short-term rentals outright, creating opportunities across the state. Cities like Kissimmee (near Disney World), Panama City Beach, Daytona Beach, Destin, and Fort Myers Beach have embraced vacation rentals with minimal restrictions. However, note that some Florida cities impose ADU-specific restrictions on short-term use, so due diligence is essential.

Texas Markets: In Texas, where there's no statewide ADU legislation, local control determines what's permissible. Cities like Austin and Houston have shown openness to ADU development, though some municipalities limit STR rentals to 30+ days. Unincorporated areas in counties like Matagorda and Jim Wells offer more flexibility, as county-level oversight of ADUs is often limited.

Arizona Markets: State law prevents Arizona municipalities from outright banning short-term rentals, though reasonable safety and insurance regulations apply. Phoenix and Scottsdale have become STR hotbeds, and ADUs can be leveraged for vacation rental income in many jurisdictions.

Tennessee Markets: Tourist-heavy cities like Nashville and Memphis offer relatively straightforward paths for STR operators, with city-specific ordinances that include permit requirements but generally allow the practice. Tennessee's strong tourism economy makes it an attractive market for ADU short-term rentals.

Select California Markets: While California has tightened ADU short-term rental restrictions in many areas, opportunities remain. Cities like San Jose allow STRs with proper registration, and La Mesa has minimal restrictions for ADU listings on Airbnb. Los Angeles permits short-term rentals of ADUs at primary residences with proper home-sharing registration. Always verify current city ordinances, as California's regulatory landscape changes frequently.

Massachusetts Select Municipalities: Under the state's new ADU law effective February 2025, municipalities can choose whether to permit short-term rentals of ADUs. Some communities, like certain areas in Westhampton, explicitly allow STRs with proper permitting. Research your specific municipality's stance.

Other Emerging Markets: Oregon, Washington, and other states with progressive ADU legislation may offer STR opportunities depending on local ordinances. Smaller college towns like Fayetteville, Arkansas, and Gainesville, Florida, have welcomed ADUs with flexible regulations.

Why MOMO by LuxMod ADUs Are Perfect for the STR Market

Umbra 2 Bed ADU model.

MOMO by LuxMod brings a revolutionary approach to ADU construction that aligns perfectly with the demands of the modern short-term rental market. Their panelized home kit system delivers the quality, speed, and design sophistication that STR investors need to compete in 2026.

Premium Features That Command Premium Rates

Modern Design Aesthetic: MOMO ADUs feature contemporary architecture with luxury finishes that photograph beautifully and attract high-paying guests. In the STR market, visual appeal directly translates to booking rates and nightly pricing power.

Smart Home Integration: Built-in smart technology enhances the guest experience while providing hosts with remote management capabilities. Smart locks, climate control, and security features are standard expectations for today's STR guests.

Energy Efficiency: Sustainable construction and energy-efficient systems reduce operating costs while appealing to environmentally conscious travelers, a growing segment willing to pay premium rates.

Customization Options: Tailor your MOMO ADU to match your target market, whether that's luxury couples retreats, family-friendly accommodations, or professional business travelers.

Speed to Market Advantage

In the STR business, time is money. MOMO's panelized construction system dramatically reduces build time compared to traditional stick-built construction. Factory fabrication means weather delays are eliminated, and your ADU can be generating income months sooner than conventional construction methods would allow.

The streamlined build process offers several competitive advantages:

Reduced construction disruption to neighbors

Earlier revenue generation

Ability to capitalize on peak seasonal demand

Cost-Effective Investment Structure

MOMO ADUs provide transparent pricing and efficient construction that helps investors accurately forecast returns. The panelized system with cold-formed steel framing controls costs while maintaining premium quality standards. For STR investors, this means better ROI calculations and reduced financial surprises during the build process.

The Financial Case for ADU Short-Term Rentals in 2026

When regulations permit, ADU short-term rentals offer compelling financial advantages over traditional rental strategies:

Higher Revenue Potential: Well-managed STRs in tourist destinations can generate $2,000-$4,000+ monthly, significantly exceeding typical long-term rental income. In peak vacation markets, monthly revenues can exceed $5,000-$8,000 during high season.

Flexibility: Use the space personally during off-peak periods while generating income during high-demand seasons. This hybrid approach maximizes both utility and revenue.

Property Value Enhancement: Adding a quality ADU like MOMO by LuxMod can increase property values by 70-120% of construction costs in high-demand markets, creating instant equity.

Tax Advantages: STR income may qualify for favorable tax treatment, and construction costs can often be depreciated. Consult with a tax professional to understand your specific situation.

Due Diligence: The Non-Negotiable Step

Before investing a single dollar in an ADU for short-term rental purposes, you MUST:

Verify Local Zoning: Contact your city or county planning department to confirm ADUs are permitted on your property and whether short-term rentals are allowed.

Understand Permit Requirements: Many jurisdictions require specific STR licenses, business registrations, and annual renewals. Budget for these costs and factor compliance time into your launch timeline.

Check HOA Restrictions: Homeowners associations may prohibit STRs even where municipalities allow them. Review your CC&Rs carefully.

Research Tax Obligations: STRs typically incur transient occupancy taxes, sales taxes, and business taxes. Factor these into your financial projections.

Review Insurance Requirements: Many jurisdictions mandate specific liability coverage levels for short-term rentals. Ensure you can obtain proper insurance before committing to the investment.

Consider Minimum Stay Requirements: Some cities impose minimum stay lengths (3-7 days or 30+ days) that dramatically affect revenue potential. Understand these restrictions upfront.

Risks to Consider

Transparency matters in investment decisions. Be aware of these potential challenges:

Regulatory Risk: Short-term rental regulations can change. Cities facing housing shortages or neighborhood complaints may impose new restrictions. Having a viable long-term rental backup plan is prudent.

Market Saturation: Popular STR markets face increased competition. Success requires professional management, superior guest experience, and strategic positioning.

Operational Complexity: STRs require active management—guest communication, cleaning coordination, maintenance, and problem-solving. Factor in management costs or your own time investment.

Economic Sensitivity: Short-term rental demand fluctuates with economic conditions and travel trends more dramatically than long-term rentals.

Make 2026 Your ADU and STR Success Story

The intersection of quality ADU construction and strategic short-term rental investment remains a powerful wealth building opportunity for informed investors who do their homework. With the right location, proper regulatory compliance, and premium construction like MOMO by LuxMod ADUs, property owners can create assets that generate strong cash flow while building long-term equity.

The market dynamics favor those who act strategically. Supply growth is slowing, pricing is strengthening, and major demand drivers like the FIFA World Cup create tailwinds for well positioned properties.

It is not too late to make 2026 your ADU and STR year of success. Contact The ADU Wizard to get a free quote, and if you buy before the end of 2025, you will only have to pay 20% down instead of the usual 50%! Do not delay and order today!

Disclaimer: This article provides general information about ADU construction and short-term rental opportunities. Real estate regulations vary significantly by location and change frequently. Always consult with local authorities, legal professionals, and financial advisors before making investment decisions. Nothing in this article constitutes legal, financial, or investment advice. The author and publisher assume no responsibility for actions taken based on information provided herein.